Pay TV shifts toward aggregation as Sky reframes its role in the streaming economy

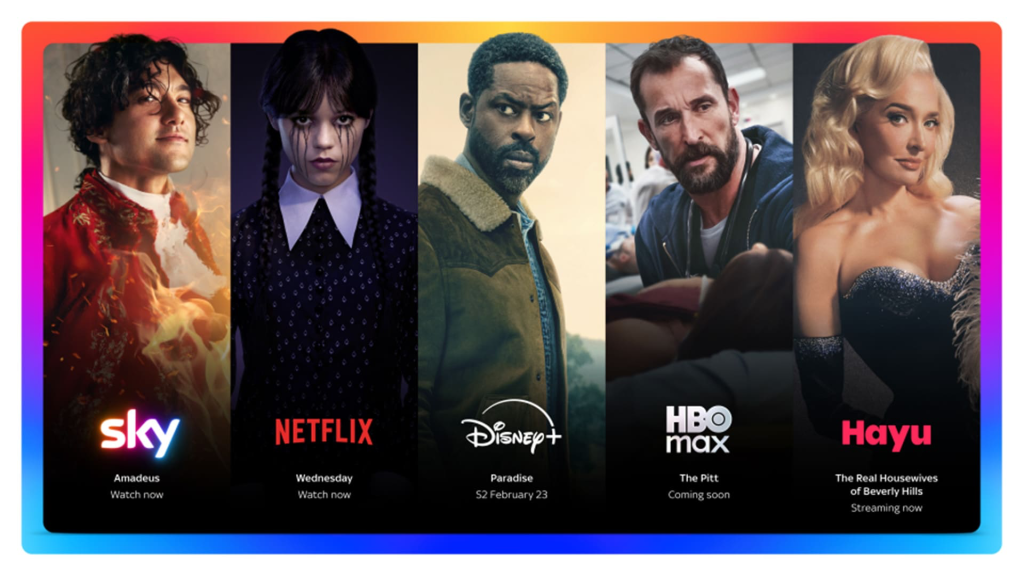

Sky has made one of its most consequential strategic announcements in years, confirming it will bundle Disney+, HBO Max, Netflix and Hayu into a single television subscription, integrated directly into the Sky viewing environment.

The move signals more than a packaging change. It reflects a structural shift in how Sky sees its future, not as a traditional broadcaster competing with streamers, but as the interface through which audiences access them.

In simple terms, Sky is repositioning itself from content originator to platform gateway.

A bundled streaming proposition

Under the new structure, Sky Ultimate TV will begin from £24 per month for new customers. The package includes Sky TV alongside Netflix, Disney+ Standard with Ads, HBO Max Basic with Ads and Hayu, in addition to Sky’s own channels and original programming.

Rather than operating as separate app subscriptions, the services will sit within the Sky interface across Sky Stream, Sky Glass and Sky Q. Sky describes the platform as a unified home screen for major streaming brands, effectively placing third‑party services alongside its own content catalogue.

For existing subscribers, integration will happen in stages.

Disney+ with ads arrives first in March. HBO Max launches in the UK and Ireland on 26 March 2026. Hayu follows in July, with a limited content sample appearing earlier in the spring.

The staggered rollout reflects the complexity of multi‑party licensing, platform engineering and distribution rights across territories.

Replacing the role of linear television

While framed as a value bundle, the announcement also acknowledges a deeper reality.

Traditional channel based television has been losing cultural and commercial ground for years. Audience attention has fragmented across subscription platforms, social media and short‑form video ecosystems. Advertising revenue has followed that migration, shifting toward digital platforms with more granular targeting capability.

Sky’s response is pragmatic. If audiences are no longer gathering around channels, the platform itself becomes the product.

Bundling major streamers into a single subscription recreates, in digital form, the old cable logic, multiple content providers, one bill, one interface. The difference is that the channels have been replaced by apps.

Strategic partnerships, not acquisitions

Importantly, Sky is not licensing individual shows.

It is partnering at platform level, distributing full streaming services within its ecosystem. That distinction matters commercially and technically.

Multi‑year distribution agreements underpin the arrangement across the UK and Ireland, allowing Sky to integrate content discovery, billing and user experience without owning underlying rights.

The arrival of HBO Max is particularly significant. Warner Bros. Discovery has confirmed a 26 March UK launch, with Sky positioned as a primary distribution partner. The service is expected to carry major franchises and forthcoming original series, strengthening Sky’s aggregated proposition.

Disney+ integration also extends beyond app access. Sky plans to launch a dedicated Disney+ Cinema channel for Sky Cinema subscribers, blending linear curation with on demand availability.

It is an attempt to bridge old viewing habits with new consumption patterns.

The interface becomes the battleground

Perhaps the most consequential element sits not in pricing but in software.

Sky OS will surface recommendations across partner services, unify watchlists, extend Continue Watching functionality and enable cross‑platform voice search. In practice, that means viewers may discover a Netflix drama via Sky’s interface without opening Netflix directly.

Control of discovery has become one of the most valuable positions in modern television.

The service that owns the homepage increasingly shapes what gets watched, regardless of who produced it.

This interface level integration places Sky in competition not just with broadcasters, but with device ecosystems such as smart TVs, streaming sticks and mobile operating systems.

A defensive move as much as an offensive one

From a business perspective, the bundling strategy carries defensive logic.

As streaming subscriptions multiplied, households began reassessing costs. Managing separate payments across multiple platforms created friction, both financial and psychological.

By consolidating billing and surfacing content through one interface, Sky reduces that friction while retaining its place in the subscription chain.

It also protects against disintermediation, the risk that viewers bypass pay TV platforms entirely in favour of direct app subscriptions.

In effect, Sky is ensuring it remains structurally relevant even if viewing continues shifting away from linear broadcast.

What it means for viewers

For consumers, the value equation will depend on existing subscriptions.

Households already paying individually for Netflix and Disney+ may see cost consolidation benefits. Others may view the ad supported tiers as a compromise compared with premium standalone plans.

The bundled interface may also reshape viewing habits. Algorithmic recommendations across services could blur platform boundaries, making content discovery more fluid but also more mediated.

There are convenience gains, though they arrive alongside deeper platform dependence

The aggregator era of television

Sky’s announcement reflects a broader industry trajectory.

As the number of streaming platforms peaks, aggregation is becoming the next competitive phase. Viewers no longer want more services. They want simplification, unified billing, unified navigation and reduced subscription fatigue.

Television is not disappearing. It is reorganising itself around platforms rather than channels.

Sky’s pivot acknowledges that reality directly.

Connectivity, access and platform reliance

As television distribution becomes increasingly app led, access depends more heavily on stable broadband, device compatibility and regional licensing frameworks.

Viewers travelling outside the UK often encounter access barriers across streaming platforms, particularly where distribution rights differ by territory. Secure network routing tools, including services such as LibertyShield, are commonly used to maintain continuity with domestic subscriptions while abroad.

As content ecosystems consolidate into fewer, larger gateways, maintaining consistent access across locations and devices becomes part of the viewing equation rather than an afterthought.

A calculated reinvention

Sky’s bundled subscription marks neither surrender nor dominance in the streaming wars.

It is adaptation.

By repositioning itself as the environment through which streaming is accessed rather than competed against, Sky is attempting to retain relevance in a market that has structurally shifted beneath it.

The success of that pivot will depend less on pricing and more on execution, interface quality, partnership depth and long‑term consumer appetite for bundled digital ecosystems.

Television’s future may not be channel based, but the instinct to gather content under one roof appears far from over.